Profit

the Sacred Cow of Capitalism

Profit is the most ingenious economic deception of them all. We are told that without this tool of self-interest, society would squander it’s brilliance and creativity and the motive to invent and achieve would disappear. This is wrong on so many levels, it’s hard to know where to begin.

Profit, it is claimed, is the little extra “value added” to the final selling price of a product or service to reward entrepreneurs for their initiative and ability and for overcoming the risk of failure. Patents are used to enshrine and protect this reward for a set period of time, giving inventors a license to steal as large a premium as possible from the marketplace. Monopolistic control of important markets provides the same opportunity. Profit raises the price of everything produced and it accumulates as goods and services are passed along the chains of production and distribution.

Profit is popular because self-interest drives a competitive marketplace and nearly everyone assumes that using profit to acquire more money will increase their purchasing power. Let me explain to you why that is not the case. If the compounding effect of profit raises prices beyond the advantage that it gives an individual, then that person would be able to buy more stuff, and be better off, if profit was abolished. Consider this simple example.

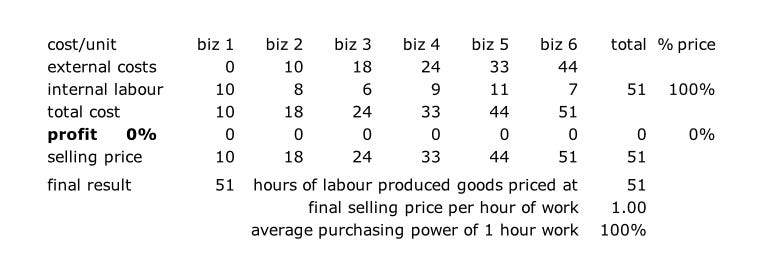

Here is a model of a production and distribution chain that consists of just 6 businesses. To keep things simple and clear prices are denominated in hours of work. The tables below track how the operations of each business affect the final selling price of the goods produced. The first table shows the final result in the purchasing power of the consumer when none of the businesses add profit to their selling price.

Notes:

(move down the column for each business to the selling price, then move across the table to the next business and repeat… the final result provides a short summary)

Biz 1 is a primary producer (eg. cuts trees to make wood) and has virtually no external input costs from other suppliers (this example just ignores his gasoline cost and the depreciation cost of using his own equipment). He puts 10 hours of labour into cutting logs and prices them accordingly at 10 hours.

Biz 2 - (doesn’t matter if it’s a single business or a bunch of businesses) buys all of the production (priced at 10 hours) from Biz 1… this shows up in the external costs line. Biz 2 adds 8 internal hours of value (labour & supplies) to the project and the accumulating selling price (or cost) increases to 18.

Biz 3 to 6 - Same thing as Biz 2. The external input costs always equal the accumulated value of all the previous members of the production chain. The indidual business then adds internal value and passes the production along the chain to the next biz.

At the end of the chain, total accumulated costs equal the final selling price (51). The purchasing power of 51 hours of work matches the total selling price of 51 hours. The purchasing power of each hour of work covers the entire selling price. (100%)

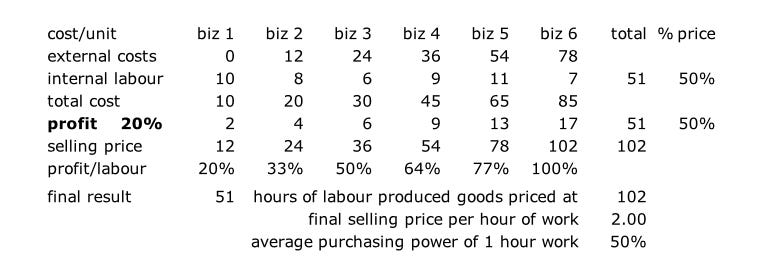

O.K. pretty simple. Now let’s add a 20% profit to the mix and see what happens. The second table shows the final result in the purchasing power of the consumer when all of the businesses add a 20% profit to their selling price.

Each Biz adds a 20% premium to the combined total of their internal and external costs. The selling price to the next Biz in the chain includes the 20% profit that the previous Biz added to his own costs. Now here’s the important part - each selling price passed along the chain already has a 20% profit embedded in it so when the next business adds another 20% profit to his own costs he is increasing the already embedded profit by another 20%… so the 20% embedded profit component now becomes 20 x 1.2 = 24, a 24% profit component. This compounding continues all along the chain and after just 6 steps doubles the final selling price of the goods produced. The purchasing power of 51 hours of work equals only half the total selling price of 102 hours. The purchasing power of each hour of work covers only 50% of the selling price. Workers must work 2 hours to buy back what they created in just 1 hour.

So does profit really even benefit those who earn it by charging others for it? Well let’s see. If profit raises an individual’s purchasing power by 20% then great! he has more money to spend, so he must be better off right?… WRONG. If that same profit level doubles the price of everything made then even the entrepreneur would be better off if profit was abolished. If prices double due to accumulated profits, getting an extra 20% in income from profit doesn’t get you ahead. The only people who benefit from profit are the patent-protected elites and monopolistic corporations who earn (and charge) far more than the average accumulated profit rate of the supply chains. This is the .1% who are stealing the true productive value of everything that workers produce

Here is a chart that shows how a 20% profit (the green boxes) accumulates as products move along the production and distribution chain. The numbers on the Y-axis at the left show the selling prices charged by each business. The internal profit (IP) charged by all previous businesses is part of the total cost of external inputs that the next business must pay. They are still identified in green as being profits each step towards the right but the IP and any XP of the previous business is an XP to the next business. The XP for subsequent businesses always includes both the IP and XP of the previous business. The same holds true for the white coloured internal IL and external XL labour inputs. Both the previous IL and XL costs become XL costs of the next business in the chain. He then adds his own IL costs and IP to the selling price and moves the product along the chain. The final column shows the total proportion of accumulated profit and labour in the final selling price. Please let me know if you are having difficulty understanding what I am talking about.

Purchasing Power Summary

without profit: all people: need only work 1 hour to buy 1 hour of product value (selling price 51/ purchasing power 51)

with 20% profit: workers (without access to profit): must work 2 hours to buy 1 hour of product value (selling price 102/ purchasing power 51)

with 20% profit: entrepreneur (with access to profit): must work 1 hour + 40 minutes to buy 1 hour of product value (selling price 102/ purchasing power 61.2) (51+20% =61.2)

Here’s what happens to the final selling price when the average profit rate grows to 50% (think that’s ridiculously high?… then think how little is paid to worker slaves in off-shore countries) 50% may actually be too low especially with patent-protected or monopoly-controlled products sold to governments.

This is the true cause of inflation and the real reason why new debt must continually be created to keep the economy running and to pay for the profits that consumers never receive as workers. There is a lot to digest here so I will stop writing now and continue the exploration of profit in the next post. Believe me the truth gets even more interesting.

I can't believe there are no comments on this post. What is going on? Is it too hard to understand? If people aren't able to see the fraud and deception in profit then it is pointless to talk about creating a better money system.

I've added another table to help clarify how profit accumulates in selling prices as goods and services move along a production/distribution chain. If you have questions please ask them here. If you think there is something wrong with what I am presenting please tell me what it is.

My question is... How do You avoid greed in an energy accounting system...?

Greed is a Symptom of Energy Accounting (article): https://amaterasusolar.substack.com/p/greed-is-a-symptom-of-energy-accounting